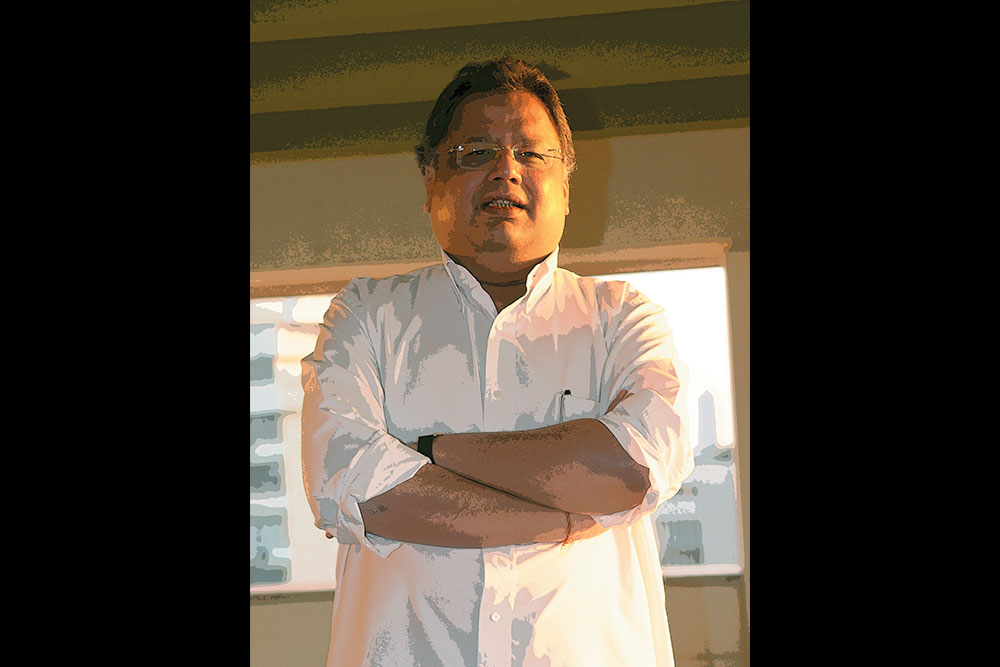

The agenda for the Association of Investment Bankers of India’s recent day-long summit in Mumbai may have been ‘Unleashing the potential of domestic investors for the capital market’ but the most interesting session there was the hour-long tête-à-tête with India’s best-known private investor Rakesh Jhunjhunwala. As expected, Rocky J was at his candid best, answering both personal and investing-related questions with trademark élan. Edited excerpts follow:

What is the question that you are asked most frequently?

People often ask me, “So, which company will be the next Titan or Crisil?” I tell them that I’m still looking for such a company. Back when I invested in these stocks, I had never imagined that my investments in both these companies would generate a 100% return. I tell people that tips are hazardous to your financial health and you can’t make money on borrowed knowledge.

We have heard that horses are an area of interest for you. Is that true?

Yes, my father was very fond of racing. As a child, I would go to the Mahalaxmi Race Course at least four days a week. It is the most wonderful place… it is very exciting. I do gamble but just not on the race course.

Are there any similarities between the highs that you experience in the market and the excitement you feel at the race course?

I am not enough of an expert on horses to have a dogmatic opinion about horse racing. But I think in the stock market, the key to my success is dogmatism coupled with an attitude to learn.

What thoughts run through your mind when you look at the trading screen?

The problem is that my mind works all the time and I end up multi-tasking a lot. I might be corresponding over the phone and emailing someone at the same time that I am looking at the screen. But once I am in front of the screen, I know exactly which stock’s price is on which part of the screen. We trade with prices. Remember, prices convey a whole lot.

What advice would you give to non-professional investors?

There are two to three reasons why one should invest in the markets. The one advice I offer to young couples is that they must invest all their savings in a house. After a house, devote 80% of your savings to the market. Here’s why: India is in a growth phase — the index has gone up from 100 to 28,000 over the past 30 years. I don’t see why this situation will not repeat itself over the next decade. This being a stock market, valuations have to grow. If India grows, earnings have to grow. India saves over $650 billion a year. In four to five years, this figure will go up to a trillion dollars. Even if 10% of that money flows into the equity markets, that adds up to about a hundred billion dollars. Why will this money not come to the equity markets? In 1991, 18% of savings flowed into equities and by 2007, this figure stood at 13%. So, there is going to be an upsurge in earnings and money flowing into the market.

If India achieves GDP growth of 12-14%, corporate profit growth will be 18-20%. At some stage, valuations will expand. Which other nation can provide this kind of growth? The most important question is if debt can give me a return of 7% post-tax or if equity can give me a return of 18% post-tax, which other asset class can give me that kind of return? Guys like me are 101% invested in equity. It’s not as if I have not contemplated investing some part of my assets in a non-equity class. In fact, I’d like to share an anecdote about this. My mother is not concerned about money at all. One day, she pointed out that I put my money only in paper and never buy property. So, I bought a flat in Malabar Hill in 2004 by selling ₹27 crore worth of Crisil shares. That flat was sold for ₹48 crore three days ago. Had I not sold those Crisil shares back then, they would have been worth ₹700 crore plus a ₹50-crore dividend.

Is there a right time to enter and exit a market?

It is very difficult to predict the right time. If you invest at all stages and under all circumstances with confidence, then you will be a fine investor. The most important thing is having the right attitude. I find that in India most people think that the stock market is a race course. People hope to double their money without realising that they could lose it too.

The two most infamous adjectives in the English language are valuable, when referring to a stock, and beautiful, when referring to a girl — they are both so relative and personal. So, when to buy and when to exit depends a lot upon the circumstances. I will sell a stock when it is highly leveraged and if I want to reduce my leverage or if I have a better opportunity or if I see a permanent impairment of value. Titan’s share price was ₹30 in October 2001. In 2006, the price was ₹61 and later shot up to ₹600. I felt that there was no permanent impairment of value. Theoretically, when the P/E ratio is at its highest and earnings have peaked, that is the time to sell. When and what to buy cannot be answered without a real-life example.

Can you talk a little more about attitude?

I have a practical approach to life. I follow the spirit of the law. I don’t want to be involved with the government in order to make money. I don’t want to do anything in life that needs me to go to the Sachivalaya or South Block or to a government office. The one time I went to the Sachivalaya was when I was setting up an orphanage and wanted to extend the FSI of the building from one to two.

Second, if money comes, that is fine. Either my money will halve or double. Maybe I will buy a corporate jet. There is nothing I really want to spend on. What I have on me everyday is an ₹800 shirt, a Titan watch, glasses, Metro shoes and a VIP suitcase. So, I don’t have many expenses. The only thing I spend on is horses. The maintenance cost of my horses is more than my household expenditure.

What are the pitfalls of success?

I have learnt an important lesson in life — success produces its own problems. People will always be envious and talk about you behind your back. Earlier, this would make me angry but now I accept it as a part of life. When I was young, my father was in the income tax department. We always had very rich friends, so there were a lot of things that we couldn’t afford but my friends could. I would go to college by bus but return in a friend’s car. My father taught me an important lesson — he always said, “Rakesh, always aspire but never envy.”

That being said, I have not faced anything much except for some harassment from the press. Between 2003 and 2005, it was assumed that because I had made money, I was a thief. I have not made money in the market by being a thief. My friends warned me that if I attended public events, the authorities would trap me. I always tell the people who threaten me that I am not scared of their threats but am concerned about my deeds. Don’t forget that India is a democracy. The other pitfall is that you can’t go to a bar with a girlfriend because everybody recognises you.

You advised young couples to buy a house first. But, at least in Mumbai, how will they manage to save so much money?

Nothing in life is easy. Today, I have got wealth and success and you might think it is easy for me to buy a house. Back then, I didn’t have an office, only a bag. In 1985, I was a Marwari chartered accountant entering the stock market. To achieve anything in life you have to fight for it and you have to believe in it. You need a little bit of luck and conviction. Saying that I don’t have the money to buy a flat won’t help.

My wife comes from a rich family. She had a car from the time she was 18 and an air-conditioner since she was born. After our marriage in 1987, we travelled by bus and I bought an air-conditioner only the next year. So, you have to adjust to the circumstances and not pity yourself. I don’t think salaries are on the lower side in India today for most middle-class families. I run a BPO where a 21-year-old starts with a monthly salary of ₹15,000 and, if he’s good, can touch ₹45,000-50,000 by the time he is 25. At 25, I was earning ₹60 as a chartered accountant.

What is the next thing you aspire to possess?

The first thing I pray to God for is to get away with certain habits and to remain healthy. As for material things, I want a lovely plot to build a house and a private jet. On July 5, 2020, I will turn 60. I want to convince my wife to donate ₹5,000 crore of our personal wealth in 2020 and again in 2025 and in 2030. I contribute 20-25% of my wealth to charity even today but I have bigger aspirations in this field. I am confident that my wealth will go up, thought not as much as I want. I am going to eat the same food, smoke the same cigarettes, drink the same whiskey and drive the same car nonetheless. If I do very well, then I may have a 16-seater corporate jet and if I don’t do as well, then I may buy an 8-seater. That is the only difference.

You have dabbled in cinema as well. How did that happen?

I love making movies — I find cinema very interesting. People tell me that I make movies so that I can meet the actresses but that is not true. I do not mix business with pleasure. I have produced Sridevi-starrer English Vinglish in 2012 and Shamitabh featuring Amitabh Bachchan and Dhanush in 2015. Both the movies have made money. I am going to partner with a huge star and we plan to make TV serials and six to seven films together. This sector is profitable and we are making money. Of course, I am not afraid of making mistakes because I don’t invest more than 2-3% of my wealth at a time. None of my investments have cost me more than ₹2 million-3 million. The two investments where I misjudged the quality and character of the entrepreneur were A2Z Maintenance and Engineering Services and Bilcare. I had blind faith in both the companies but I have learned from my mistakes. And, as I always say, the best is yet to come.

What would be your criteria while hiring an investment banker?

One of my partners happens to be an investment banker. We are disinvesting partly in an Ahmedabad-based company. He does everything and helps me find companies where I can find the right valuation. I prefer honest bankers. My merchant banker told me the A2Z issue would never be subscribed and I said that was impossible. The IPO was priced at ₹400 and there was a shortfall... I put in an additional ₹70 crore. Later, I sold all the shares at ₹10-11 apiece.

How do you balance your investments with trading?

I had no money when I started. Trading started for me as a compulsion; I have invested only what I want in it. I love trading more than investing because in the latter you put both your capital and your brain at stake. In the former, you only put your brain at stake. I invest all my stocks in my wife’s and my own name. I have a partnership firm called Rare Enterprises, whose only work is trading. I think this year we will pay about ₹150 crore in taxes.

There is nothing wrong with trading — it is all about momentum and leverage. You have to trade with an attitude, you have to be humble. Trading is like a T20 match, you give and take quickly. Investing is like a test match. You have to compartmentalise your investments. I never trade my investments. If Titan is at ₹350 and I sell 50 lakh shares, I know that the price will go down to ₹300. So, I only trade liquid scrips. You should have a girlfriend and a wife and keep them both happy. Then you will know how to do both trading and investing.

What are the attributes that are very important for an investor?

You have to be dogmatic. Between 2006 and 2008, the market doubled and Lupin’s share price was at ₹600. Over the next six years, the share price jumped to ₹7,500. I was the second-largest investor and my conviction paid off. I have purchased 20 million shares of Rallis India, which means I own 10% of the company. In this whole rally, the stock has not gone up. I am holding on to it because I believe in it. I review each of my investments and if the original thought process based on which I bought the share makes sense, then I hold on to it. If you think you are always right and the market is wrong, you will not learn anything. Only humility and a desire to learn will ensure progress.

If not an investor, what would you have been?

Well, I always wanted to be a journalist. If you are a good journalist, you can bring about profound change. I even contemplated becoming a counsellor. But at the age of 16, I decided that my future lies in the stock market. My parents agreed and my father advised me to do a chartered accountancy course or else nobody would marry me or give me a job. Today, I don’t manage anybody’s money and am not answerable to anybody. I have only one client and that is my wife.

If the government invites you to join it in an advisory capacity, what role do you see for yourself?

Disinvestment is an area where I think I can contribute. The Indian government’s disinvestment is done in a haphazard manner — they don’t know how to choose companies to sell. China raised $15 billion-20 billion in 2003-2004 via disinvestment. Why should we not sell 25% of our good undertakings and raise $25 billion-30 billion? I think the worst corporate governance employed by an organisation in the country is that by the government. I am a shareholder of HPCL. What right do they have to give my wealth for their subsidy? You can’t use these PSUs to achieve social objectives. It may restrict the number of scrips that I can trade or invest in but I think I can help with planned disinvestment.