It has been a one-way ride down for Cummins India since the stock touched an all-time high of Rs.1,247 on August 7th 2015, on the back of a strong June 2015 quarter. Since its all-time high, the stock is down 32%, as declining exports has dragged its overall performance. Thankfully for the company, the domestic business is helping them stem the fall with a slow recovery. Over the past three months, Cummins India has corrected nearly 9% and its market cap has eroded by Rs.2,375 crore, partly driven by market sentiment and partly on concerns related to the growth prospects of the company. Analysts now believe that the concerns have been overdone and the current underperformance (absolute: -20% YoY and relative: -22%) gives long-term investors a good entry point as the crude oil price is starting to look up and domestic demand is also gathering momentum. At the current valuation, analysts believe all the negatives seem to be priced in, while the positives of having strong technical expertise, dominant market share in the segment it operates, and access to a wide range of products in the parents’ portfolio remain undermined.

Cummins India’s business is spread across two key product categories — power gensets and industrial engines. Gensets are used for power back up in industries where access to grid may be limited or in industries that need continuous access to power. The industrial business caters to the diesel engine requirements of the industrial sector. The company has more than 50% share of the power generator market in the medium and high horsepower segment, and has been the focus area of the company. The genset business accounts for 38.4% of the domestic business, while the industrial engine business accounts for 17.6%. The remaining revenues are contributed by auto, distribution and exports.

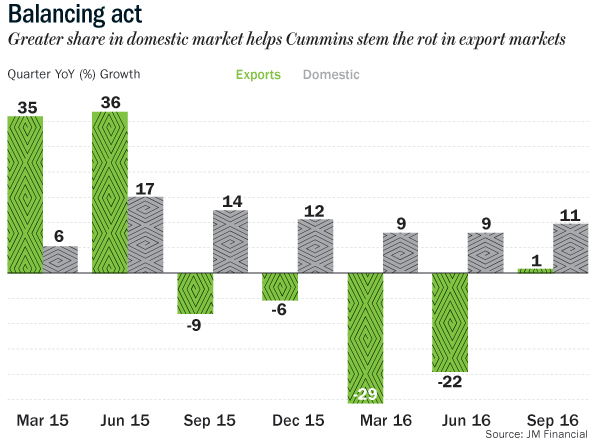

While 65% of the company’s revenue comes from the domestic market, exports contribute a chunky 35% to the topline. Cummins’ key export markets like Latin American countries — Argentina, Brazil, Venezuela and countries in Africa and Middle-East, have their economies linked to crude oil and the sharp fall in global crude prices have hurt the demand in these markets. Falling crude prices saw the oil-rich nations cutting their capital expenditure plans.

Revival ahead

However, analysts expect the export markets to recover in the next three-four quarters. Part of that optimism stems from the 13-member oil cartel — Organisation of the Petroleum Exporting Countries’ (OPEC) decision to cut crude output to check the global glut in oil supply. The move is expected to push up crude oil prices, which is currently trading at $50 per barrel. “We are seeing commodity prices and crude oil prices firming up. The expected pick-up in infrastructure investment augurs well for future earnings of the company. From FY18 earnings perspective, the stock looks attractively priced,” says an analyst at Emkay Global Financial Services, who didn’t wish to be named.

Demand for Low Horse Power (LHP) gensets is expected to improve as the industrial activity in these commodity-linked economies is picking up. The management expects LHP genset exports to increase by 2x to Rs.2,000 crore by FY20, led by market share gains and increasing presence in the MENA region. “Demand should improve in the next term, especially in regions like Middle-East, Africa, Latin America for low power kVA sets,” says Ankur Sharma, vice-president (research) at Motilal Oswal Financial Services.

Domestic gain

Back home, domestic demand is showing signs of recovery. Domestic sales were up by 11% YoY in the September 2016 quarter. The industrial segment grew 35% YoY in the same quarter, driven by revival in road construction, water rigs and railways. “The domestic recovery is continuing at a slow pace and it’s largely driven by government spending,” observed Anant Talaulicar, chairman and managing director at Cummins India, in a recent earnings call.

The industrial business could be the next big growth opportunity for Cummins. “Historically, the power generation business has been the mainstay for Cummins. We expect the industrial business to catch up, as railways, road construction and defense sectors are expected to see a surge in investments,” says an analyst. In 2QFY17, sales in the industrial segment grew 36%, marking third consecutive quarter of sharp sales growth. The growth was led by a surge in investments in roads and railways.

Cummins India has had a better time back home with domestic sales growing at 18% in FY16, despite a challenging competitive environment. “We feel optimistic because our industrial businesses are linked to infrastructure, and this is where the government has really stepped up in the last couple of years. We have seen very strong action in the road segment particularly, and that has really helped our construction segment. I think the overall market there has expanded by almost 30-40% and our sales have commensurately grown. Sales have probably exceeded the market growth because of our share improvements,” added Talaulicar during the earnings call.

The management has maintained its guidance of 8-12% growth in domestic business in FY17. During the September 2016 quarter, the power genset segment grew by 5% on a higher base and the management believes that multiple drivers are in place for future growth. While the demand for LHP and MHP gensets would be driven by retail and realty, the HHP gensets, which is the biggest revenue contributor to this segment, is seeing an increasing demand from data centers and healthcare, apart from retail and realty.

The company faces competition from players like Perkins in the medium and high horsepower segments. Kirloskar Oil Engines has also recently entered this segment, but customers’ unfamiliarity with the company in this segment would make it difficult to compete in a market where customers cannot take a chance on product reliability. For instance, 60% of Cummins’ volume come from repeat customers. The UK-based Perkins started its operations in India in late 2015 at its Aurangabad plant, but may find it tough to compete with Cummins, which boasts of a strong dealer/service network and 400 touch points.

The management is not too worried about the growing competition. “As you know we have the largest scale in the country. We have localised products. We have very strong supply base, very strong engineering team and of course, global parent that is very strong. So, with all of that we feel confident,” said Talaulicar in the last call. Cummins is one of the few multi-national companies in India, which houses the global research and development center in India. Cummins does global R&D in Pune, the spend on which is equally shared between Cummins Inc and Cummins India. As on FY16, Cummins India’s royalty outgo stood at Rs.44 crore or 1% of FY16 sales. In 2012, Cummins India had announced that the incremental new technology exports would be manufactured by an unlisted subsidiary of the parent. Analysts say that it should not have any material impact on Cummins India’s revenues, given the potential of its existing product portfolio and the latent demand in the domestic market.

Cost conscious

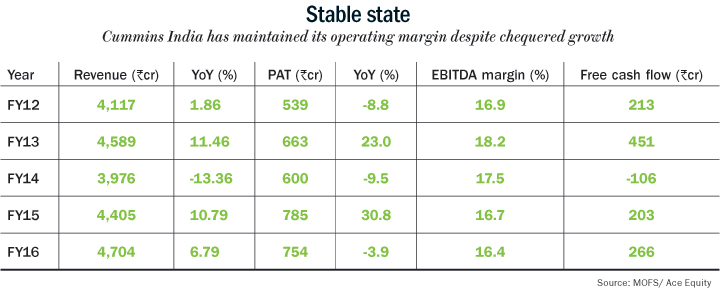

The company has maintained its operating margin at 16%, even with cuts in pricing amidst intense competition. But in recent quarters, the major drag on margins has been slowing exports that fetch higher margins and higher contribution from the low-margin LHP and MHP gensets. The management says that it has been tackling these issues by bringing down product-specific costs. Over the years Cummins has managed to improve efficiencies through accelerated cost efficiency programmes aimed at reducing direct material spending, cost reduction in indirect materials and Six Sigma. These initiatives have helped Cummins reduce its material costs by 2-2.5%. Historically, the company has controlled its costs well whenever margins are under pressure. Even this time around, analysts believe that the company should be able to save 100 basis points on costs and protect its margins.

Cummins India has a better ROCE and operating margin profile when compared to most of the MNCs in the BSE Capital Goods Index. It’s return on equity, which measures how efficiently a firm is using shareholders’ money stood at 25% in FY16. The company’s revenues are estimated to grow at a CAGR of 11.52% over the next three years, while net profit is expected to grow at 13% during the same period.

Analysts feel that Cummins India can spread its wings into multiple segments like power, telecom, automobile and mining. It can provide for both stand-by use (back-up gensets) and high-hour application (engines used for operational requirements). Given Cummins’ strong technical know-how, they believe that the company is well-positioned to grow its business even if market dynamics in terms of fuel preferences change, say from diesel to gas.

Cummins India is currently trading at 23x its estimated FY18 earnings, compared to the 25x-41x one-year forward multiple of its MNC peers in the BSE Capital Goods Index. The current valuation is closer to the long-term (5-year) average P/E multiple of the stock. “Cummins deserves premium valuation versus peers, given its dominant market share in large power genset segment. It presently has 57% market share in the 750 kvA segment. Tightening emission norms, expanding industrial portfolio and rising production mandate from parent for global markets are key value drivers over 3-5 years,” feels Amit Mahawar, analyst (institutional equities) at Edelweiss Securities.

The company operates in a business that is both technology and distribution-intensive, which makes it a high-entry barrier business. Cummins has spent Rs.400 crore per year on incremental capex during FY14-17, which is now going to be limited to Rs.50 crore–100 crore. This should increase the dividend pay-out from the current 60%+ level. Cummins’ ROCE of 25-30% is among the best in the capital goods universe. All these factors strengthen Cummins India’s case as a stock to buy at the current price of Rs.850.