An uneasy calm filled the air one morning in July 2013 at ShopClues’ Gurugram office. Employees were just trickling in, but the atmosphere was tense with hushed conversations about what had happened while they were fast asleep. Sandeep Aggarwal, their boss and the e-commerce marketplace’s co-founder had been arrested in the US on insider trading charges. Although unrelated to the ShopClues operations, it raised questions about what the future would hold for the employees. The CEO was taken in for allegedly tipping off a portfolio manager about a pending deal while working at Wall Street. The co-founders — Aggarwal’s wife Radhika who headed marketing and Sanjay Sethi who headed operations — sprung into action. They addressed a nervous workforce over the next few days and presented a strong front.

Everything seemed under control. It had to be. It had just been four months since the two-year-old company had raised $10 million from names such as Helion Venture Partners, Nexus Partners and Netprice as a part of its Series B funding. They had everything going for them — an early headstart in the non-Tier-I marketplace, a strategy that set them apart from the biggies in the game (Amazon and Flipkart) and a focus on bringing unorganised products on to an organised platform. It already had over 200,000 products on offer on its platform, being sold across 7,500 locations. With 2,500 transactions a day and an average ticket value of Rs.1,000, it wasn’t doing too badly in comparison with Flipkart that had an average ticket value of Rs.2,000.

Shopping for slots

This story was playing out when India was waking up to an e-commerce boom — internet user base was hardly 100 million, venture funds were on the prowl for the next big thing, and Flipkart was trying to figure out the market, but was mostly known for being a convenient bookstore. Amazon was not in the picture yet. Plus, names such as Snapdeal, FashionandYou and Yebhi were the only other e-commerce players, besides Flipkart, that were thriving. Aggarwal, who had spent much of his professional career in the US, was intrigued by the India story and the opportunity was irresistible. So, while the big players focused on the large metros, ShopClues decided it would focus on Tier-II and below — it hoped to profit by selling many products not easily available to those customers.

Essentially, ShopClues sold everything from cheap electronics and apparels to cutlery, idli-makers and furniture, from small traders around the country. It was like Amazon, but it catered to the ‘real’ India, with products priced as low as Rs.79. Everyone was fighting for the city buck because margin was higher and the customer was easy with the purse, but ShopClues was doing then what most companies are doing today — catering to 65% of the country. Naturally, small businessmen and non-urban consumers felt wanted and ShopClues onboarded as many as 350,000 partners and one million monthly active users by 2014. With offers such as ‘Sunday Flea Market’ and ‘Wednesday Super Saver Bazaar’, the start-up had seized the slot left vacant by the big players.

Clearly, Aggarwal’s past could not have reared its ugly head at a more inappropriate time and when he’d be back was anybody’s guess. “After Radhika and Sethi had addressed everyone, the panic had lessened but not everyone was convinced,” recalls a former employee who was at the start-up during that trying period. Both Radhika and Aggarwal did not respond to Outlook Business’ email queries.

Even though Helion and Nexus had backed Aggarwal and his idea in the beginning, they were clear that he could merely stay on as a shareholder and nothing more. Although the investors were not too happy with Sethi, a technology and product expert, becoming the CEO, since Aggarwal had recommended him, they didn’t have another option; Radhika was out of the running for being Aggarwal’s wife.

For ShopClues, it was time to re-strategise or surrender, and an initial round of discussions for a sellout was initiated with Flipkart in November 2013. But, the homegrown giant was unwilling to write a cheque for anything over $70 million.

The funding cycle also got affected since Nexus was hesitant to commit the next round of funding, eventually agreeing to invest another $15-20 million, six months later than they had initially planned. That’s also when Amazon started getting aggressive in the country. “It was impossible to handle so many things at one time,” recalls a former employee. The tech giant had figured out its supply chain for Tier-II and Tier-III centres and with its endless capital and high-quality customer experience, it became a huge threat.

No one’s got a clue

Things improved to peachy, before getting much worse than before. (See: Raining money) Two scenarios began to play out — competition intensified and an internal power struggle got ugly.

After pressurised by investors, Aggarwal stepped back to make way for Sethi and Radhika. The Aggarwals’ marriage disintegrated too and all of this did not go well with the people backing the company. After returning in mid-2014, Aggarwal declared war when he wrote to the board with suggestions on running the company even though he did not have an executive role. Sethi and Radhika were running the ship then. “Obviously, Sandeep was insecure and the new dispensation began to look at the marketplace strategy from scratch,” says an e-commerce rival.

Meanwhile, Amazon and Flipkart were closing in. According to Satish Meena, senior forecast analyst, Forrester, the company’s core business model was under pressure. “That platform had stopped evolving and buyers started moving out of ShopClues. Now, one would buy an affordable T-shirt on the site but when it came to a smartphone, it would be on Flipkart or Amazon,” he says. The two that today dominate over 60% of the online marketplace had started making ShopClues or even Snapdeal irrelevant. Once a large player such as Amazon enters the long tail segment, it offers the product and several more at the same price. The former ShopClues official confesses, “We could not equal them in technology or price.”

Investors were drawn to the e-commerce opportunity but they bet much bigger on rivals. In early 2015, Tiger Global led a $100 million funding in ShopClues, on a $350 million valuation. But, it infused $1 billion in Flipkart! “The strategy was to back two different sets of buyers, which was a smart thing to do. With the market opening up, they decided to go with Flipkart,” says Meena.

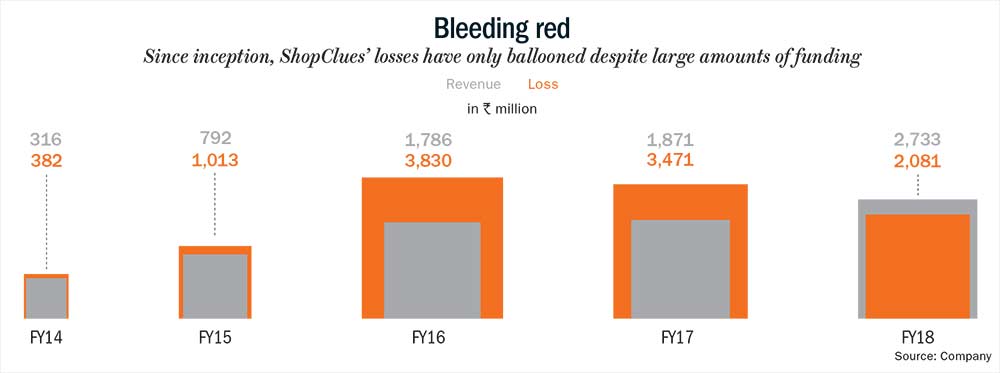

In 2016, ShopClues became a unicorn when investors such as GIC, Tiger Global and Nexus pumped in another $100 million. It made headlines for it was the fourth unicorn in the country, at a time when unicorns were not born every third week like in 2019. What didn’t make the headlines was the increasing stress and bleeding losses of ShopClues (See: Bleeding red). “For GIC, it was obviously a fear of missing out and anyway, it was not a large amount for them. It was around the time when Snapdeal also raised $200 million from Canada’s Ontario Teachers’ Pension Plan,” says Meena.

Sramana Mitra, founder of Silicon Valley-based One Million by One Million, a virtual incubator, does not mince words when she says, “$250 million in funding to deliver barely $30 million in revenue with red ink the length of the Ganges is just not reasonable, and most definitely doesn’t justify a billion dollar valuation. At best, it warrants a $90 million valuation.” She bluntly says that the start-up was simply lucky with the timing, and had thus become overvalued 10x. In fact, For FY18, on a revenue of Rs.2.73 billion, it posted a loss of Rs.2.08 billion and has been in the red since inception. “The times they were active in the market coincided with the times of excess in the Indian e-commerce market and they were showered with capital,” she adds and goes on to say that their failure was led by unhealthy dynamics apart from “a total lack of focus on business fundamentals”. Other companies such as FashionandYou, Yebhi and Askme also went bust despite having big money pumped in.

False bubble

It was well-funded and ShopClues wasn’t too off from the 8% market share it had in 2015, despite its troubles. That’s when they decided to pivot. The first decision was to launch private labels in mid 2017, and off the block was Home Berry for home décor and furnishing. The former employee says it was a clear deviation from the marketplace strategy. “How could they take on the biggies without technology, expertise or funding?” he asks. However, a confident Radhika in an interview with TechCircle in April 2018, said 5% of ShopClues’ revenue came from private labels. She was aiming to push that to 20% by the end of FY19. By now you may have realised it’s not a story with a happy ending, and that goal was never achieved. Investors and analysts alike questioned this move. “They either had to continue with the low price commodity model or move on to being a full-fledged brand. The hybrid approach was never going to work,” adds the former official.

Meena believes it’s extremely difficult to sell private labels in unbranded categories since demand is always uncertain and a company needs to have a massive user base. Only one example of success comes to his mind — Pinduoduo in China — a company that has a large user base of over 350 million. In contrast, ShopClues has just 10 million monthly active users, hardly 20% of what Flipkart and Amazon have. Industry experts believe Radhika and Sethi only cared about valuation. It became an obsession and they were only concerned about the number of transactions to drive gross merchandise volume (GMV). “All this only led to making them more vulnerable to Amazon. ShopClues just wanted to be the cheapest at any cost,” one points out. Being a unicorn sent the founders on cloud nine, and the organisation had started boasting that they were “getting ready to be bigger than Flipkart”.

But what they didn’t reveal was the liquidity crunch at the company. It had started talking to everyone for a potential deal — Flipkart, Paytm Mall and eBay to name a few. Nothing, however, is more unfortunate than what transpired with Snapdeal.

The first round of discussions in early to mid-2018 defined the broad contours of a merger. ShopClues, being the smaller entity, would hold 10% stake with no day-to-day responsibilities. Back then, this deal was worth $250 million. Sethi and Radhika thought it was being undervalued, according to those familiar with the development. “Besides, they wanted to run ShopClues post the merger as well. It was ego that came in the way and the deal never went through,” adds the source. Talks with eBay also fizzled out and in the process, its business and valuation took a further hit. When talks with Snapdeal restarted after a few months, it was being valued at $175-200 million. The buzz that the mess was bigger rattled the Snapdeal management. “They developed cold feet and backed off,” says the source.

A report released by Forrester in 2018 presents the true story of where ShopClues stands. Market share on the basis of GMV is almost equally split between Amazon and Flipkart at 31-32% each. ShopClues at 1.6% lags behind Myntra, Bigbasket and even the struggling Snapdeal.

Once the skeletons started falling out of the closet, employees began rushing out. A head of a large retail chain remembers being flooded with CVs from ShopClues employees in early 2018. As he interviewed a few of the candidates, it was obvious that the “vigorous enrolment of vendors had stopped”. Narrating the story, the executive today says that was the symptom of money running out. “Employees were openly discussing the troubles with competition. It was obvious that ShopClues was at the end of its story,” they add. From a peak of 800 employees, the company has only around 300 today.

ShopClues was nearing the end of the road, and in October 2019, it announced a deal with Singapore-based Qoo10 — a fire sale at just $60-70 million — a value that the company had refused from Flipkart just a few years ago because it believed it was worth much more than that. Meena expects the new buyer to use a cross-selling strategy, where products will be sourced from China to be sold in India. “They will need to attract new users and that is a challenge since customer acquisition cost is very high. They will not spend billions of dollars. There is an opportunity with a small market share if they can get in a new set of customers with good product offerings,” he explains.

And Aggarwal was watching the descent from the office of his now $550 million company that he founded in 2014, Droom. In a detailed post on LinkedIn right after the ShopClues deal, Aggarwal rubbed salt into the wound by saying he was clear in October 2013 that the company “would go belly up if I wasn’t involved for 24 months. So, I did not care whether I was welcomed or not by the board or whether I got paid or not or whether I had a formal title or not or whether the current management would get all the credit for my work”. Even as he wrote he did not care, he mentioned it has been painful to see this $1.1 billion asset falling under $100 million. “I saw the company going down as pronounced by its conversion rates going down to half, none of the television commercials making any impact, unit economics not improving and most importantly, lack of any new innovations or disruptions,” he said.

ShopClues’ decline could be material for a Netflix thriller. A series of questionable business decisions apart from the founders bickering were only some of the reasons that led to this debacle. And as we told you earlier, this story does not end with a happily-ever-after.