Just like governments, a CEO’s impact starts becoming visible only after a few years. In hindsight, Vivek Paul’s exit and the dual CEO structure that followed can be identified as the point when Wipro started falling behind its peer group. The dual structure created an inefficient organisation and a culture that was marked by organisational silos. TK Kurien inherited this structure and he started improving Wipro’s competitiveness with a decision to emphasise the vertical structure by using that as the P&L axis. Under Abidali Neemuchwala, who comes with a background that is steeped in vertical-specific business process outsourcing (BPO) operations, we expect Wipro to deepen its vertical sales expertise and create many as-a-service propositions. We think it is worth noting that TCS signed both the $1.2 billion mega deal with Nielsen (an integrated IT and BPO deal) and the acquisition of Citigroup’s captive BPO operations for $505 million happened when Abidali was heading the BPO operations.

Digital strategy at work

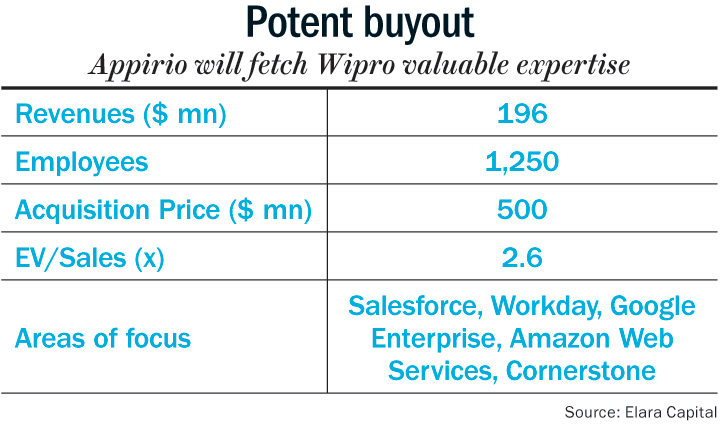

CEO Abidali’s stated vision is that ‘consultative selling across domain and technology’ is ‘critical to the advisory offering in digital.’ We see this strategy at work in the acquisitions of Designit for user experience and Appirio for its digital technology execution capability. Improving local market presence in markets such as continental Europe (rationale for the Cellent acquisition) and Canada (a bonus from the Atco deal) is another part of the strategy at work. We think local market knowledge is helping Wipro create niche value propositions such as the recently launched decision making and analytics solution for treasury management software by Bellin, which has a wide base in Germany.

Good strategic investment

The acquisition of Appirio for $500 million will help Wipro become one of the largest service providers in Salesforce and Workday implementation and support with credible pre-built solution accelerators. We regard this acquisition as an excellent strategic investment, at a valuation similar to the acquisitions of Bluewolf by IBM and Cloud Sherpas by Accenture. The acquisition of Appirio, Health Plan Services in February 2016 and the recent launch of a treasury decisions and analytics solution, based on the Bellin treasury management platform, are all examples of an attempt to define a value proposition that is markedly different from its peers. This should help Wipro gain entry into new accounts. With Appirio, Wipro not only gains valuable expertise and credentials for popular Software-as-a-Service (SaaS) platforms of Salesforce and Workday, but also gives it Google and Amazon web services expertise. We think this is valuable expertise as more clients look at operating hybrid cloud environments (that is, a mix of on-premise and public cloud infrastructure). This could be a valuable differentiator for Wipro’s infrastructure management services. Wipro has stated its intent to consolidate its Salesforce and Workday practices under the Appirio brand and having Appirio CEO Chris Barbin lead the business.

As one of the last large independent practices for Salesforce and Workday, Appirio is justified in being paid a slight premium over its peers that got acquired slightly earlier. Wipro has stated its intent to consolidate its Salesforce and Workday practices under the Appirio brand and having Appirio CEO Chris Barbin lead the business. We think that maintaining a separate brand and culture is important as operational integration would be difficult, given the need for very different policies and compensation structure for such firms. We note that Wipro has taken a similar approach to integrating Designit and it seems to have worked since the headcount has nearly doubled.

With an improvement in digital competitiveness with Appirio and Designit buyouts and a pickup in the energy and utilities vertical (17% of revenue for Wipro versus 4-5% for TCS and Infosys), we expect Wipro can narrow the growth gap with its peers in FY18.

Apart from acquisition of Appirio to add new technology skills, Wipro has also developed an artificial intelligence platform Holmes. The platform has seen application in not just automation of IT

delivery activities such as ticket management, but also in areas such as eKYC for a bank, virtual retail assistants, pre-authorisation for healthcare claim management. Wipro has taken a point of view that their platform will not own the data, which we think is an overlooked aspect of Wipro’s competitiveness.

Energy build-up

Wipro has finally seen a bottoming out of the energy vertical with a quarter on quarter revenue growth of 1.3%, in constant currency terms, in the second quarter of FY17. The management has suggested that CY18 is likely to see energy customers increasing their spending. A historic deal struck in December 2016 between Opec and non-Opec members to cut production has already resulted in firmer oil prices. We expect this could translate into a cyclical uptick in spending and provide another boost for Wipro’s revenues in FY18.

Wipro’s energy and utilities vertical should ideally have seen strong growth following its mega deal with Canadian energy and utility firm Atco in July 2014. This deal, apart from giving Wipro additional revenue of $112 million a year, also positioned the company as one of the largest IT services providers to upstream energy companies. When Wipro announced the deal, crude was trading at $103 a barrel. By December 2014, it had fallen to $53. Following the Atco deal, Wipro added $19 million to its energy and utilities vertical in 2QFY15, but lost $3 million in the subsequent quarter and a further $19 million in the fourth quarter as clients started jettisoning IT projects in response to the sharp fall in crude. This pattern has continued as crude oil prices have remained soft ever since. Wipro’s energy and utilities practice alone had an annual run-rate of $1,190 million at the end of 2QFY15 and it has declined to $989 million by the second quarter of FY17 — a total loss of $202 million in annual runrate, in what ought to have been Wipro’s strongest vertical in comparison with its peer group. Even if its energy vertical had remained flat since the second quarter of FY15, Wipro’s quarterly average growth rate would have been 1.3% instead of 0.99% — a 33% difference in growth rate. In comparison, TCS clocked a quarterly CAGR of 1.35% over the same period. So, if it hadn’t been for the woes of the energy and utilities vertical (which was 17% of revenue for Wipro versus 4% of revenue for TCS in 2QFY15), there would have been practically no difference between the growth rates of TCS and Wipro.

Closing in

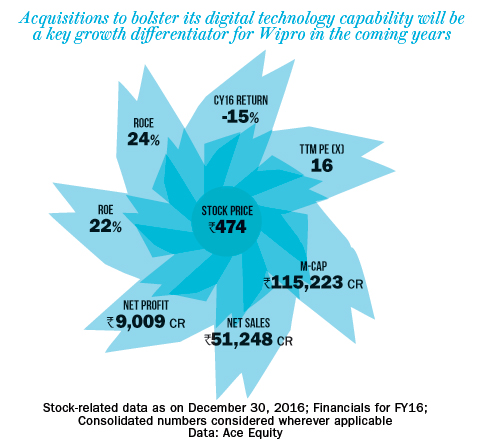

While energy continues to be a bugbear for Wipro, we think the worst is over as its strengthened capabilities will help the company improve win rates and prevent it from losing vendor consolidation. We expect the rerating to continue and maintain our price target of Rs.665, based on 16 times estimated FY17 earnings. We urge investors to switch from TCS and TechM to Wipro as we continue to be pessimistic about a rerating prospect for TCS (expecting growth below top-end of peer group) and are concerned about TechM’s competitiveness beyond the telecom vertical.

The writer has no position in the stock but Elara Capital has recommended the stock to its clients