After witnessing a remarkable high in 2014, private equity investments have seen another uptick of 20% YoY in Q1CY15. Early data from Venture Intelligence — which tracks PE data — reveals that PE firms invested about $2,646 million (excluding investments in real estate) across 124 deals during the quarter ending March 2015. The value invested is 20% higher than that invested during the same quarter last year ($2,212 million across 132 transactions), but interestingly, it is 36% lower than the immediate previous quarter (which saw a whopping $4,120 million being invested across 112 transactions).

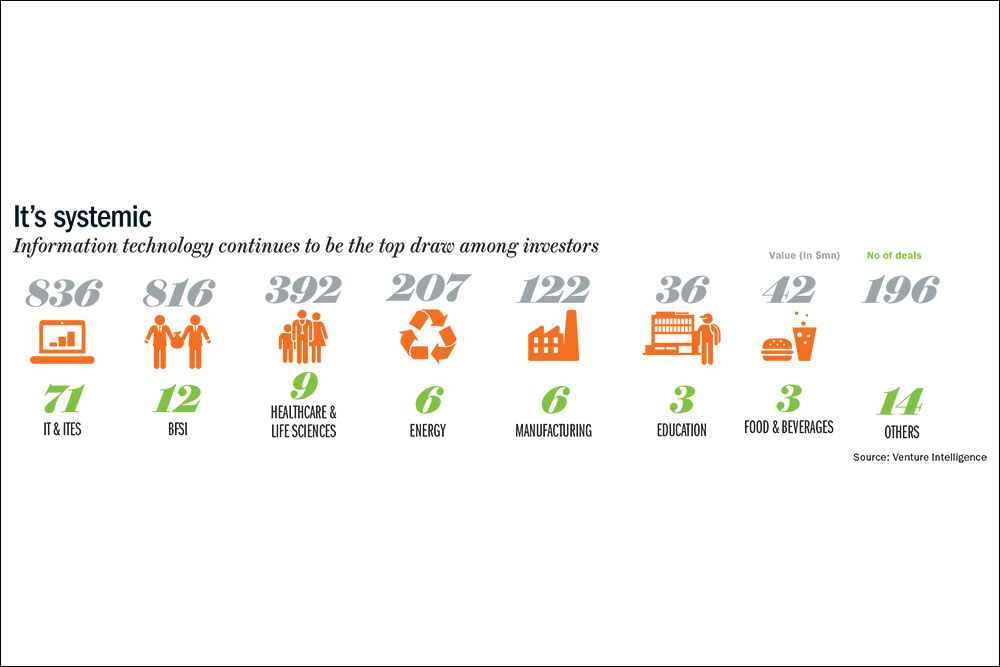

Sector-wise figures show that IT & ITeS companies won the biggest piece (32%) of the value pie this quarter, attracting $836 million across 71 deals. Banking, financial services and insurance companies came a close second at 31% — $816 million across 12 deals, while healthcare and lifesciences companies drew investments of $392 million across nine transactions and energy firms received $207 million across six transactions.

There were six headliners (deals worth $100 million or more) during the quarter, compared with four in the same period last year and eight during the previous quarter.

At the top of the list was IFC’s $260 million to microfinancier-turned-bank licence holder Bandhan Financial Services. Ujjivan Financial Services, also in microfinance, drew $100 million from investors including CDC Group, IFC and CX Partners. In healthcare, Manipal Health Enterprises and Medanta Medicity attracted over $100 million each.

The peak of Q4CY14 was on the back of big investments in e-commerce companies, and though Q1CY15’s has seen a slight pause in e-commerce funding, the web hasn’t entirely been left out. Leading the list this time was the $100 million received by Shopclues (its fourth round) led by Tiger Global, also a key investor in Flipkart.

Despite regulatory and fuel linkage concerns, power continues to draw attention. IDFC Alternatives invested about $81 million in an SPV of Diligent Power that is setting up a 1,200-Mw thermal power project in Chhattisgarh.

In terms of secondary transactions between PE firms, significant transactions include Carlyle’s buyout of Destimoney from former majority owner New Silk Route and Ujjivan, where half of the funding went to its exiting investors.

Transactions in the venture capital space (investments under $20 million in early-stage firms) accounted for 68 of the total 124 PE transactions (55% of the volume pie but 12% of the value pie). On the other hand, late-stage companies (including Bandhan, Manipal, Medanta and Ujjivan) attracted 27 investments, securing 45% of the value pie. Venture capital transactions were dominated by a follow-up round led by Tiger Global in Culture Machine, an online video content company, which received $18 million, an investment of $16.25 million led by Matrix Partners India into food ordering app Tinyowl and QSR chain Faasos, which received a round of $16 million led by Lightbox.

BFSI companies were the winners in the listed companies space, with Magma Fincorp drawing $80 million from India Value Fund, Leapfrog and KKR, and M&M Financial attracting about $42 million from Temasek.